The dust has settled on E3 2019, and it’s time for me to grab my Excel and run the coverage numbers from this year’s show.

Those of you who have been following my annual reports for some time and may be looking to make comparisons between this year’s data and historical analysis and should note that we’ve redesigned our tool set to gather data from more sources. It makes the 2019 report the most comprehensive to date but does skew the extent of the coverage in 2019 vs 2018 to look more positive.

Overall trends

This year’s E3 will be one to remember, not only because of what was shown (the very first announcement of Xbox Scarlett; Keanu Reeve’s breathtaking appearance), but also what wasn’t shown, most notably Sony’s decision to skip the event altogether.

In spite of this break in tradition, Sony’s absence hasn’t reduced the amount of PlayStation games being talked about , but does set an interesting precedent with significant potential to impact future videogaming events.

Platforms

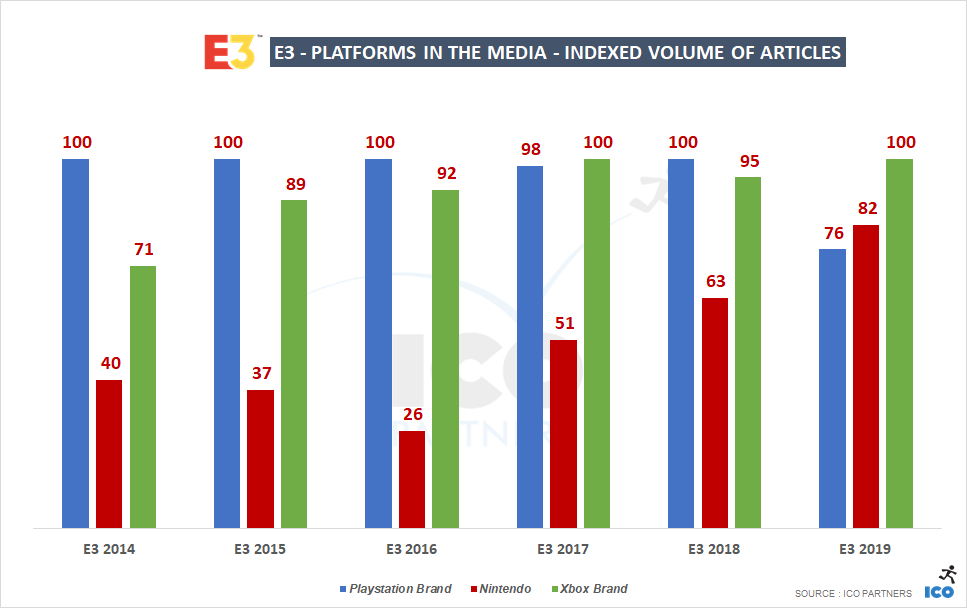

This chart illustrates the levels of coverage for the main three console brands. It’s important to recall my opening note about comparisons to historical data here. The change in our tools means the variation in the volume of coverage over the years is not comparable. But, the variation of coverage between the three main brands over the years is.

The coverage is indexed around the brand achieving the largest volume of articles each year.

Here’s my take away from these numbers:

- Nintendo, historically on the backfoot when it comes to overall volume of media coverage, has finally caught up. Securing more coverage than PlayStation. This could be seen as an easy battle to win with Sony skipping E3 but the 2014-18 data illustrates this is a strong progression.

- In spite of their absence Sony still secured a massive amount of coverage, 76% as much as Xbox, given the huge overhead not incurred by attending the show would count this as a win. The logical next step would be for them to set up a strong following for their own events.

- Xbox can state they came up on top this year, (finally). However their lead, is not quite as impressive as it could be considering the press event revealed the first insights on a new generation of console, and unveiled the most anticipated game of the show; Cyberpunk 77.

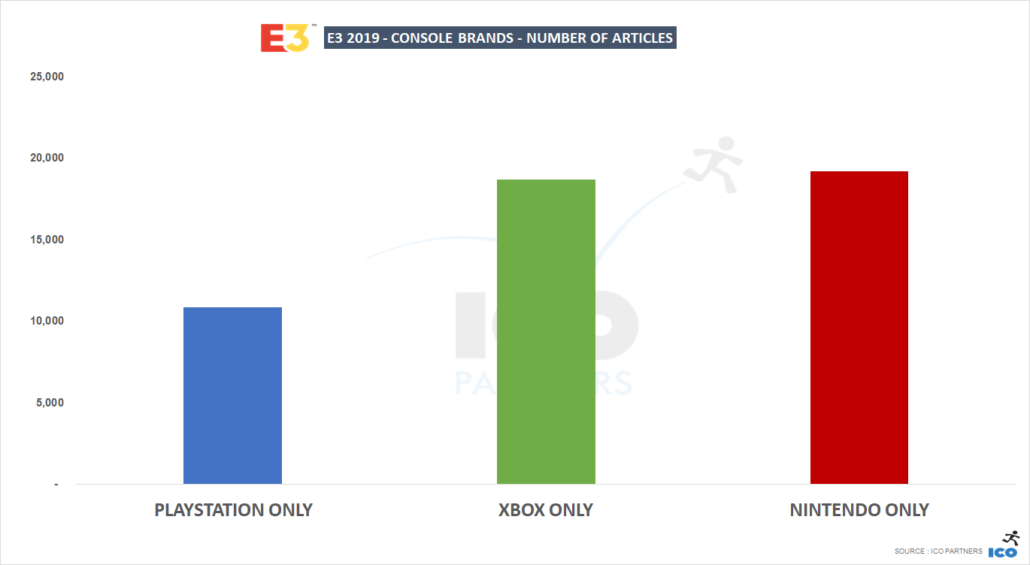

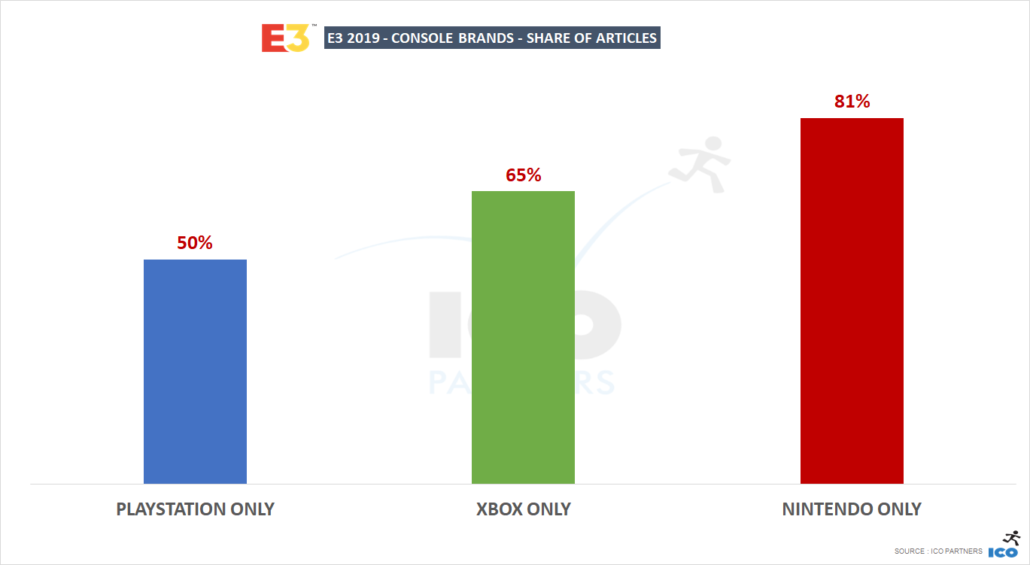

Looking article volume with only a single platform mention highlights well how PlayStation managed to stay present while absent. The vast majority of articles mentioning PlayStation also mention at least one of its competitors.

Nintendo did well in achieving coverage where it was referred to as a platform in isolation, without mention of Xbox or Sony.

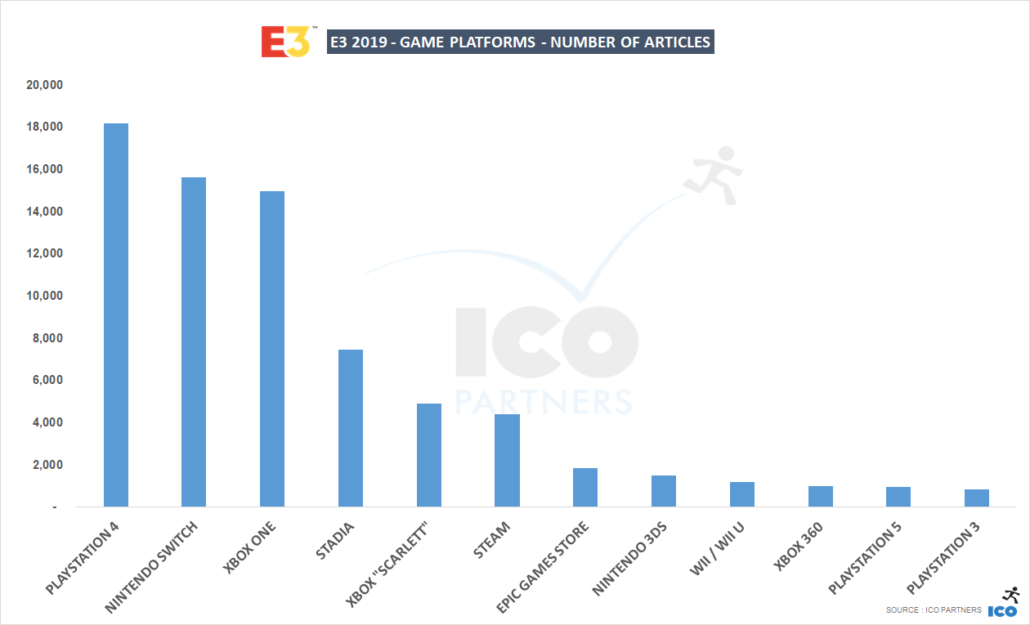

Looking solely at platforms coverage highlights the level of the PlayStation strength. Of all the platforms, with no official press event, PlayStation 4 still leads as the most mentioned console in all articles from E3 week.

Additional considerations on platform performance::

- Stadia performed very well for a newcomer. Google is still relatively new to the gaming scene, but coverage levels suggest they are being taken seriously.. Timing may have helped, organising their event the week before E3, traditionally considered the “calm before the storm”.

- Steam historically hasn’t been mentioned a lot in E3 coverage. The fact that the Epic Games Store is emerging as a contender in the PC space might be helping Valve, with many PC related announcements now being much more explicit on which store they are releasing.

- The Nintendo 3DS is still getting a reasonable volume of coverage, despite its age.

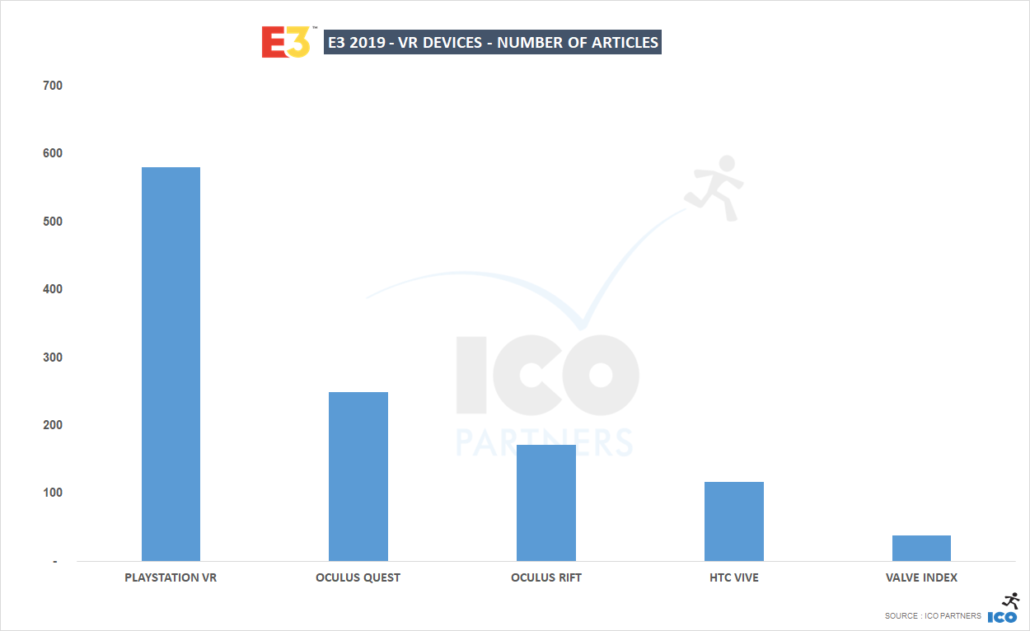

VR didn’t have a strong presence at this year’s E3 however here are some interesting observations relating to its coverage:

Our tool change makes a definitive on the drop in VR news at E3 challenging to establish however the data and anecdotal feedback from the show would suggest a big drop in VR news in 2019.

In total, there were 2,439 articles during that week that mentioned VR or VR devices. The interest is still there, but there was a significant lack of VR-specific announcements compared to previous years.

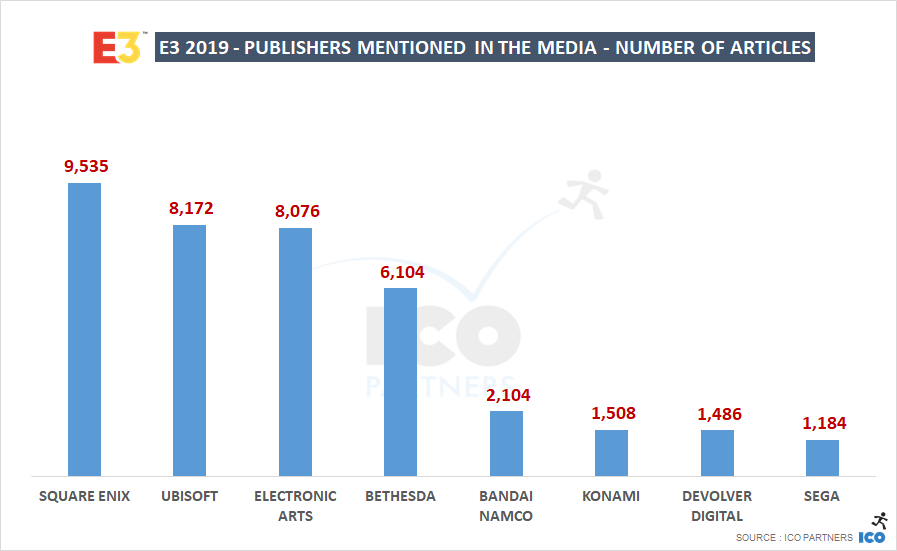

Publishers

Unsurprisingly, the publishers that hosted a press conference are ahead of the ones that didn’t. However Square Enix taking such a strong lead is unexpected.

This is the first time since I have been tracking the media coverage of E3 that it has happened.

Another performance of note is Devolver Digital showing up in the chart, ahead of Sega and Activision (not shown here) and almost at the same level as Konami. Devolver is hosting its own event, but in the past, it didn’t get them to get that volume of coverage in the past.

Games

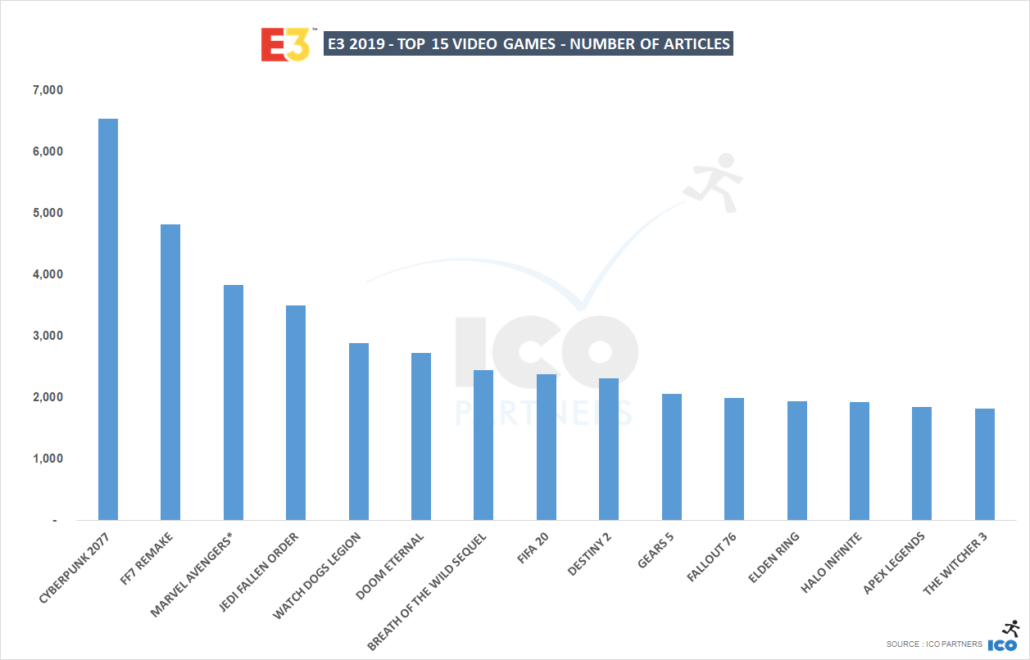

Here is my view on the top games in the media:

- With such a high volume of games on show those that manage to stand head and shoulders above the others pretty much guarantees big things ahead. Cyberpunk 77 is getting the top spot in 2019, and with a relatively quiet launch window of Spring 2020 its potential is significant

- Final Fantasy VII remake is still drawing a lot of attention, despite having been announced four years ago.

- Marvel’s Avengers debuted with a bang. One of the reasons Square Enix did so well in the publisher’s overall coverage, along with FF7 and FF8. [Note: the Avengers number shown here is coverage explicitly mentioning the game]

- Apex Legends and Elden Ring are the only new franchises showing here. An excellent performance for Elden Ring in particular, following both the game and partnership announcement between FromSoftware and George RR Martin, both strong brands themselves.

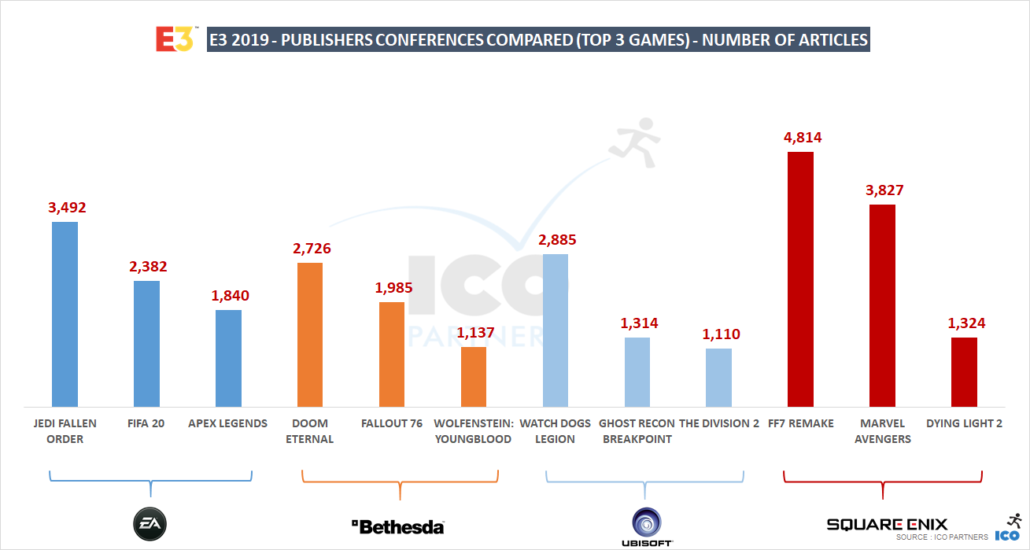

This chart breaks down the performance of individual games with the specific publisher conferences and highlights how Square Enix got the top spot.

Last week, Niko Partners’ Daniel Ahmad did a series of very interesting tweets that complement the numbers above. They show the performance on Youtube of the main games showed at E3. I highly recommend having a look at the thread:

Update to most viewed games at E3 2019 list.

This is based on youtube videos views for games shown at E3 2019.

Includes promoted/ad views. pic.twitter.com/7U53HcMTqK— Daniel Ahmad (@ZhugeEX) June 13, 2019

The variation in the ranking between media coverage and Youtube views can come from a difference in interest between media and Youtube audiences, but it is also important to note that marketing spend might influence Youtube videos, increasing viewer volumes over those that are purely organic.

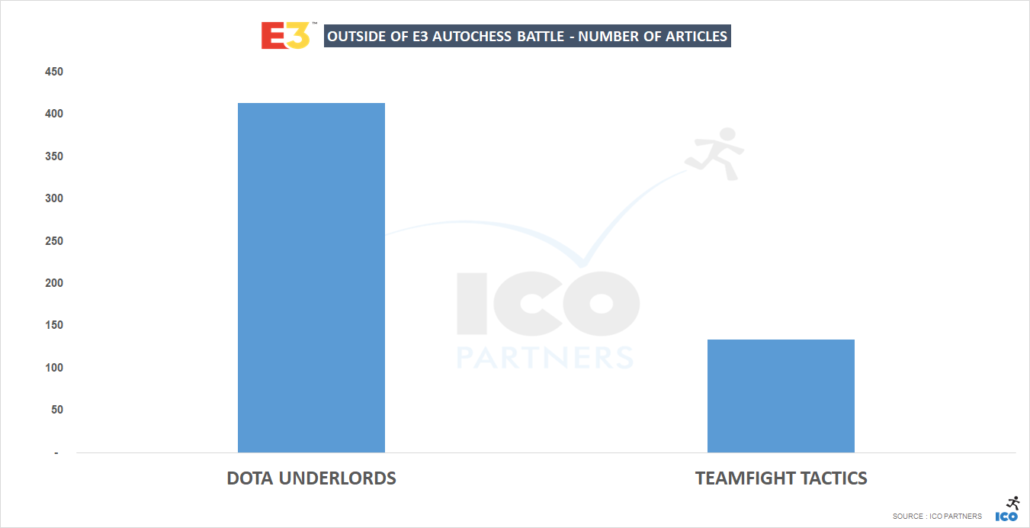

AutoChess Battle

Lastly, I wanted to mention something odd that happened during E3.

On the 10th of June, in the heart of the E3 media storm and the press conferences, Riot Games announced its new game, Teamfight Tactics, their own take of the AutoChess mod.

Riot is known to communicate to its own community first, but announcing its first significant game beyond League, early during the week of E3 seems unusual, even for Riot.

However, on the 13th of June,Valve announced DOTA Underlords, their take on Autochess, available right away for Battle Pass owners. While Valve’s timing is also unusual one would assume that either Riot decided to get ahead of Valve or Valve reacted to Riot.

Looking more closely at how these two announcements went:

The data suggests that going first didn’t do Riot any favour. And even for Valve, this is not an impressive level of media coverage, especially during E3 when the volume of content surges and drowns anything that doesn’t have a huge momentum.

Methodology Note

Over the years, the tool sets I was using have aged. Late last year, we decided to overhaul the technology stack we are using, to adopt more modern libraries.

This was a difficult decision to make – while the new tool is more precise, and more future-proof, it also means the data we have accumulated over the years cannot be compared with the new dataset.

The core of the methodology is the same, its fundamentals have not changed. However, we are now parsing even more websites, and we can track them in near real time.

This made it possible for me to do a first assessment of the most popular games during E3:

https://twitter.com/icotom/status/1139439847834312704

It also means I cannot with a certitude compare, for example, the Xbox media coverage from 2014-2018 to the E3 2019 Xbox media coverage.

As a reminder, all coverage for E3 is over an eight day period, from 9-16th June with the exception of Stadia and EA. (Both have their own events ahead of the show so the window during which they are tracked is 6-13th June and 7-14th June respectively).

The previous set of tools prompted many years of interesting discussions and insights and we look forward to being able to provide even more detail and data for years to come.

Leave a Reply

Want to join the discussion?Feel free to contribute!